Wrike has a ready-to-use monthly budget template that can help you set up a robust budget tracking system quickly, without any coding or special knowledge required. Wrike’s monthly budget tracker template can help

#Budget spreadsheet sample software

Reviewing your budget data using accounting software will also help you anticipate your future spending needs, profits, and cash flow.

If you find you’re getting a good return, that’s useful information when it comes to future decisions about allocating resources. Revisit it every month and see where you can adjust or experiment - maybe shift some funds to give your marketing budget a boost for a few months and see how it affects your sales pipeline. It should not be a static document that you check once a quarter or only at the start of the year. Now that you’ve set up your monthly budget, make sure to revisit it periodically.

#Budget spreadsheet sample how to

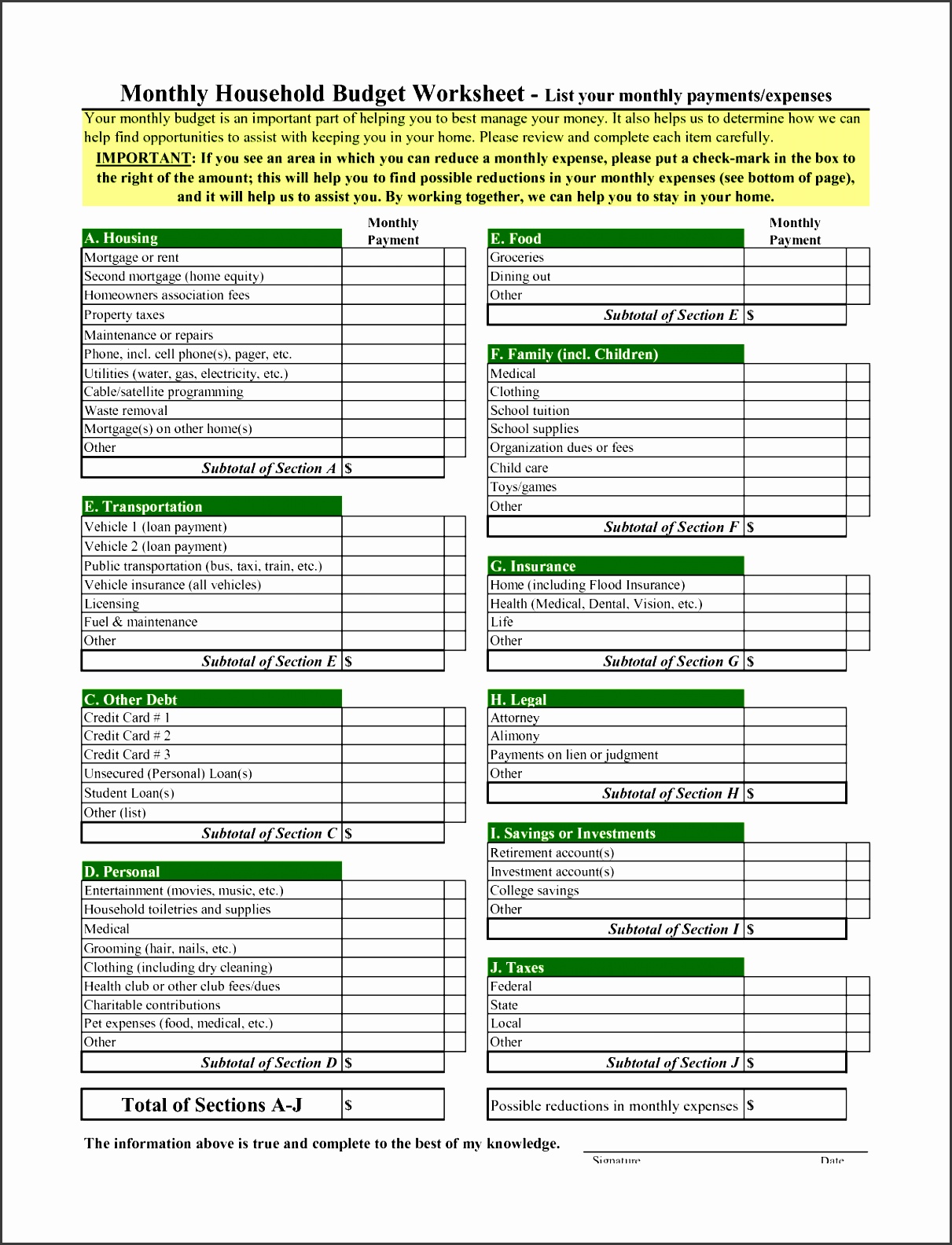

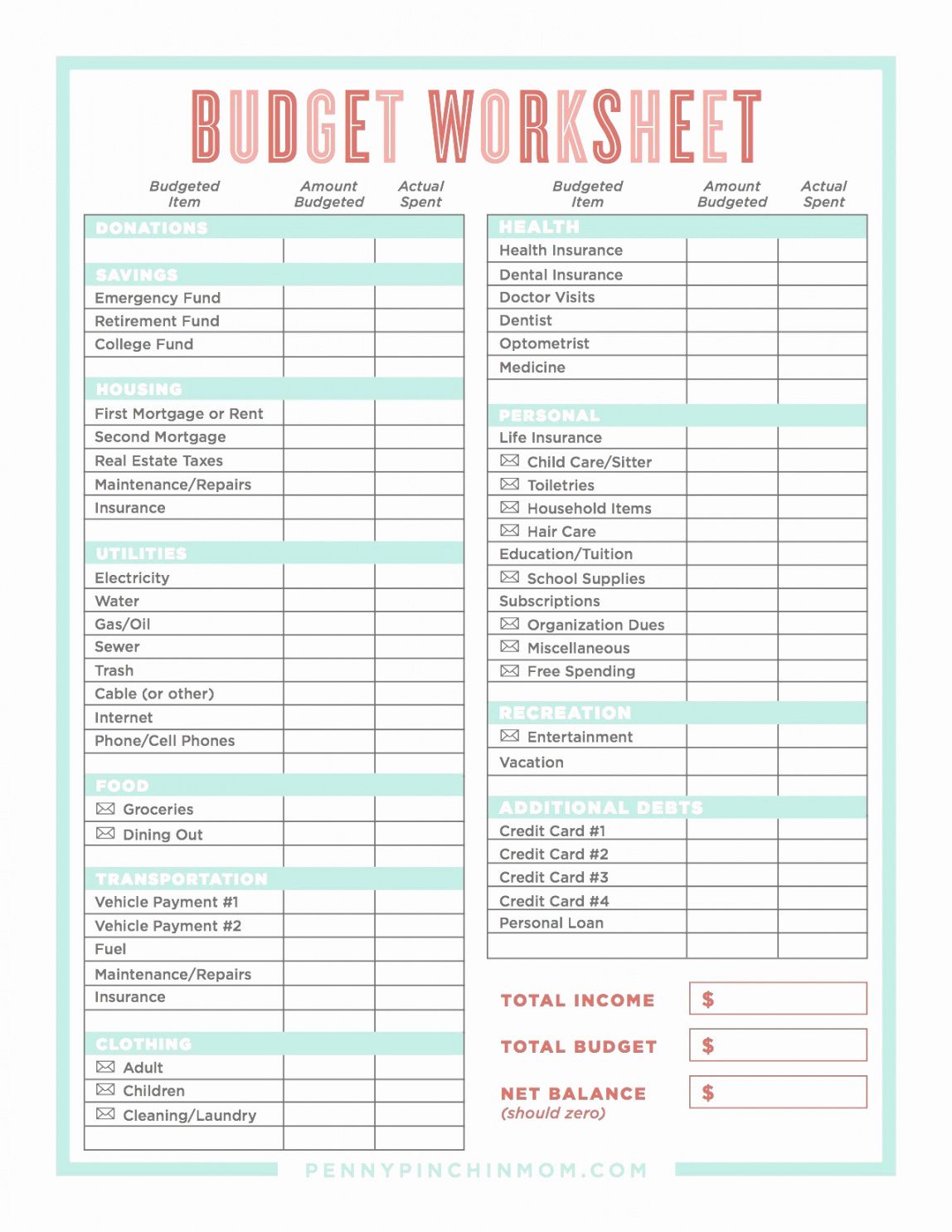

Once you have a profit estimate, you can determine how to invest in your business, whether that means upgrading equipment, moving to a larger office or better location, adding staff, or giving your employees raises. Profits: To determine profits, subtract your costs from your revenue.Semi-variable costs: These expenses are influenced by the volume of your business, including salaries, marketing and advertising, etc.Variable costs: These costs typically correlate with sales, such as the cost of raw materials to produce your product, inventory, shipping/freight, etc.These figures don’t typically change from month to month. Revenue: Estimated sales figures (err on the conservative side if you can't be exact).Here is what you need to include in your monthly expense sheet: Costs such as employee salaries, lease payments, utilities, and insurance are all recurring monthly expenses, whereas line items such as purchasing equipment and consultant fees constitute one-time costs. It’s helpful to categorize these expenses to get a clear idea of where your budget is being spent.Ĭosts involved in a monthly budget typically fall into two categories: monthly expenses and one-time costs. Making a monthly budget can seem daunting, but it essentially involves writing down each and every expense you expect to have over the course of a month. How much money do you have? How much do you need to spend on materials, manpower, and marketing? How much revenue is required to meet your business goals? Can you afford to buy new equipment, run a new advertising campaign, or hire another team member? Do you have an emergency fund you can tap into if unexpected costs arise? These are all key questions that will help you determine your starting point for your monthly and annual budgets. You need to start with basic questions that will help you gauge your finances. That’s why it’s so important to take the time to create an accurate and realistic budget that’s specific to your business and goals. It can help you minimize risk and experiment with how to best allocate resources. It’s a key factor when raising capital, whether you're applying for a loan or pitching to investors, and a cornerstone of your business plan. Your monthly budget planning worksheet is a roadmap for your business, helping you define priorities, understand where your business is going, and determine whether you’re on the right path.

Let’s start with the building blocks: monthly budget planning. If you want to make your life even easier, we offer an easy-to-use monthly budget template that will help you log expenses, sort costs by category, view monthly spending, and examine budget details - all within Wrike. This article will help you understand small business budgeting basics to help your company thrive in 2023. But whether you are a manager or a business owner, creating a budget is absolutely essential to your success. We know you’d almost certainly rather spend time refining your product, talking with happy customers, or honing your investor pitch than hunch over spreadsheets, calculating the seemingly impossible amount of money it’s going to take to get your business off the ground. Starting a business can be an overwhelming process, with business plans, leases, financing, legal documents - and monthly budget sheets.

0 kommentar(er)

0 kommentar(er)